Working with Software Modules

Sale Return ...

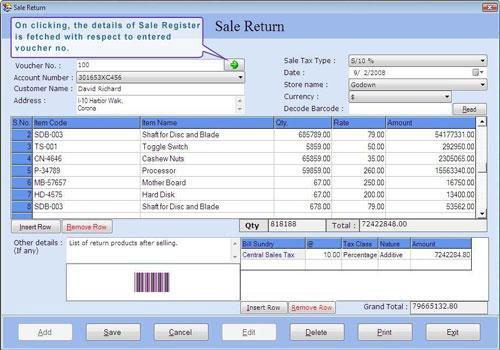

Sale Return Voucher is a legal document which contains the record of all those sold goods which are returned to the Company by the customer.

Software provides facility to enter Sale Return transactions by clicking on “Voucher Entry > Sale > Sale Return”, the following screen will be appeared:

This screen contains the following fields:

-

Voucher No.: This field displays the voucher number of Sales Return. The voucher number is increased incrementally from previous voucher number or you can enter the voucher number manually. You can easily fetch the existing voucher number details of sale register by clicking on this button.

Note-> If Barcode feature is being used then voucher number should be of minimum 3 characters.

-

Account Number: Select the account number to be affected on Sale Return Voucher. This list displays those accounts which are under group of Sundry Debtors, Sundry Creditors, Cash-in-Hand, Bank account and Sales account.

-

Customer Name: This field displays the customer name according to selected account number.

-

Address: This field displays the address of customer according to selected account number or you can also enter the address manually.

-

Sale Tax Type: Select the tax type for sale. In this list those tax types will be displayed which is created under the Sale during Tax Type creation in Masters.

-

Date: Select the date of Sale Register. By default, Date will be Current Date which can be set during Settings > Date Administration > Current Date.

-

Store Name: Select the store name where the goods are received after sale return. In this list those Stores will be displayed which is created during Store Creation in Masters.

-

Currency: Select the currency in which the Company’s transactions will be done. In this list, those Currencies will be displayed which are specified at the time of Company Creation (as called Primary Currency) and Currency Creation (as called Secondary Currency) in Masters.

Note-> If you select Secondary Currency then enter Conversion Rate during Currency Converter to make relation between Primary and Secondary Currency.

-

Decode Barcode: Enter the barcode value of the item which is specified at the time of Item Creation in Masters. After entering the barcode value, click on “Read” button (or read barcode value by using Barcode Scanner) to fetch the item information of related Barcode value.

If you use the Barcode Scanner to read the barcode value then you don’t need to enter the barcode value manually.

Note-> This is the optional field through which you can save the time to enter the barcode information.

Item Details

-

S.No: This auto-generated field displays the serial number of item.

-

Item Code: Select the item code from the Item Code list and press Enter or Double Click. The selected information will be displayed with Item Name and Item Rate. (The Item Code list is displayed after pressing any key on the item Code field).

-

Item Name: Select the item name from the item Name list and press Enter or Double Click. The selected Item information will be displayed with item Code and item Rate. (The item Name list is displayed after pressing any key on the item Name field).

-

Qty: Enter the quantity of the item.

-

Rate: By default, the sale price of item is displayed which is specified at the time of Item Creation in Masters or you can manually enter the sale price of the item.

-

Amount: In this field the displayed amount is calculated by multiplying the quantity and rate of item.

Item Detail also consists of the following fields:

-

Qty.: This field displays the total quantity of items.

-

Total: This field displays the total of items amount.